Due Diligence

A complete guide to getting to know us

We understand that vetting potential partners can be time-consuming and, frankly, a bit of a hassle. That’s why we’ve taken the initiative to compile all the information you might need in one place.

As a fellow professional, you’ll find detailed insights into who we are, how we operate, and what we can bring to a collaborative relationship. Our goal is simple: to make your decision-making process easier and to demonstrate our commitment to transparency and professional integrity.

Emery Little at a glance: Our story in numbers

Numbers tell a story, and ours is one of longevity, progress and impact. Here’s a snapshot of Emery Little’s key figures as of October 2024, giving you a clear picture of who we are and the scale at which we operate.

Assets under management

More than just a number, this represents the trust placed in us by hundreds of families. It’s the foundation upon which we build financial futures and lasting legacies.

Years in business

Over five decades of evolving financial expertise. We honour our roots while continually adapting to meet changing client needs, always following the latest evidence to inform our strategies.

Families served

Each family represents a relationship built on trust, understanding, and shared aspirations. We’re proud to be the chosen partners in these families’ financial lives.

Employees

Small enough to care, large enough to deliver. Our team size allows us to offer personalised service while having the breadth of expertise to handle complex financial needs.

Our story

Each point on our timeline represents a step in our ongoing journey of growth and learning. As you scroll through, you’ll see how Emery Little has grown and adapted over the years, always with an eye towards better serving the families who trust us with their financial futures.

.

Real people, real results

We specialise in turning financial uncertainty into a clear path forward. But don’t just take our word for it—hear from our clients about how we’ve helped them move from ‘what if’ to ‘what next’, enabling them to live life on their terms.

Clients we best serve

We work with a diverse range of clients, but find our approach particularly beneficial for individuals with the following characteristics:

Our Chartered status

Being chartered represents the gold standard in financial planning. Awarded by the Chartered Insurance Institute since 1912, this status means we’ve committed to exceeding industry standards in qualifications, professional development, and ethical practices. It’s our public pledge to maintain excellence in everything we do, ensuring our clients receive the highest quality financial guidance and service.

Our key investment principles

We believe in a systematic, evidence-based approach to investing. Our philosophy is grounded in academic research and long-term market behaviour, designed to deliver robust returns while managing risk effectively.

Faith in capital markets

We believe in the enduring power of global markets to drive long-term wealth creation. Despite short-term fluctuations, history shows that markets have consistently rewarded patient investors over time.

Risk and return are related

We recognise that higher potential returns come with increased risk. Our approach involves understanding and balancing these risks to align with clients’ financial goals, acknowledging that there’s no reward without calculated risk-taking.

Markets are efficient

We accept that market prices generally reflect all available information, making consistent outperformance challenging. Rather than trying to outsmart the market, we focus on efficiently capturing returns through a systematic approach.

Long-term focus

We adhere to a systematic, evidence-based strategy that emphasises patience and long-term thinking. Our disciplined approach helps manage emotions through market fluctuations, avoiding reactive decisions based on short-term noise.

Investing in knowledge

We believe ongoing learning enhances our ability to provide exceptional service. Our team pursues qualifications beyond industry requirements, aiming to offer well-informed, comprehensive financial guidance. This commitment to professional development reflects our dedication to supporting clients’ financial journeys effectively and staying at the forefront of our field.

Dynamic team, proven principles

We’re proud to have a team of young, passionate financial planners. Their energy and fresh perspective keep us at the forefront of the industry, while their commitment to evidence-based practices ensures our advice remains grounded and relevant. This combination of youthful dynamism and rigorous adherence to proven principles, supported by insights from our experienced partners, means our clients receive financial guidance that’s both innovative and dependable.

Our service

We believe in enduring relationships, not one-time transactions. Our service is a comprehensive, ongoing financial partnership that evolves with clients’ needs. This includes, but is not limited to:

We provide clients with a comprehensive Annual Planning Meeting each year, complemented by continuous support tailored to individual needs. While some clients find the annual meeting sufficient, we’re available for more frequent guidance when complex financial situations arise. This flexible approach ensures clients receive responsive, appropriate support throughout their financial journey, often identifying areas where specialist advice from other professionals may be beneficial.

We help navigate the complexities of building secure financial futures for clients. Our approach considers unique circumstances, aligning strategies with lifestyle goals. We clarify options, optimise contributions, and create sustainable income plans. This thorough process often uncovers pension-related legal and tax considerations that may require expert input from other professionals.

We develop strategies to help preserve wealth for future generations. Our approach balances current needs with legacy goals, helping clients make a lasting impact on their family’s financial wellbeing.

We help navigate the ever-changing tax landscape, identifying opportunities to improve clients’ positions. Our strategies aim to support broader life goals and aspirations, complementing other professional services they may receive.

Our approach centres on achieving enduring results through evidence-based principles. We build robust, diversified portfolios aligned with clients’ financial goals and long-term objectives. Regular reviews ensure investments remain in tune with evolving life circumstances.

This powerful tool brings clients’ financial futures to life, helping turn abstract numbers into tangible plans. We create visual representations of financial journeys, allowing for informed decision-making and providing clarity as clients progress towards their version of true wealth. These models can incorporate insights from various financial aspects, offering a comprehensive view that can inform other professional advice.

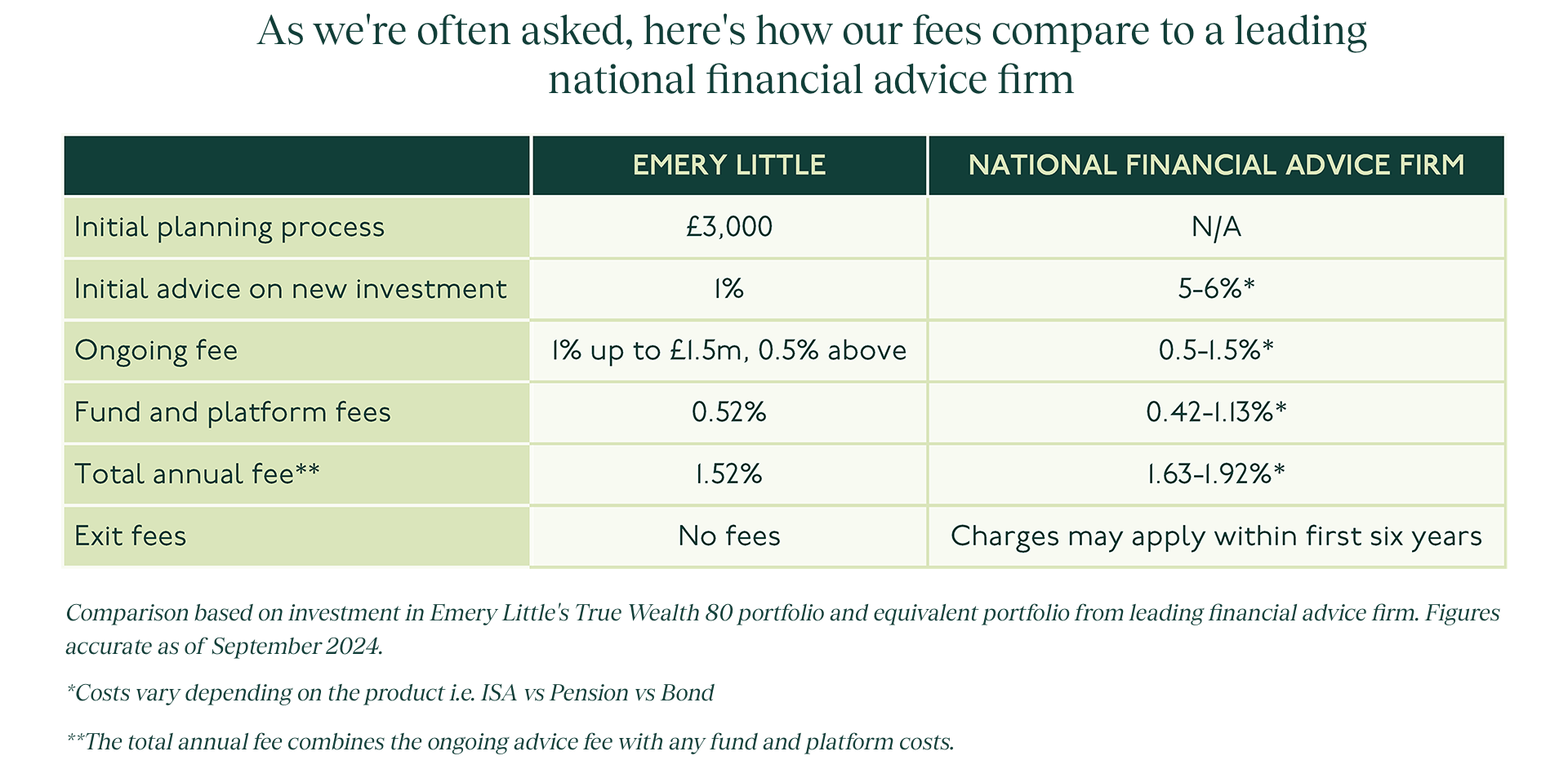

How we charge

We believe in transparent pricing that provides value without compromising on service quality.

Initial consultation call

We offer a complimentary hour-long call to understand potential clients’ financial needs and assess if our services are a good fit.

Initial planning process

If the client decides to move forward, we charge a flat £3,000 for the initial planning process, resulting in a tailored financial roadmap.

Ongoing service fee

We charge 1% annually on assets up to £1.5m, and 0.5% above this threshold, ensuring continuous support and management of the financial plan.

New investment fee

A 1% fee applied to all new investments, covering advice and implementation of additional capital allocation.