Like clockwork, January brings the usual flood of market predictions and economic forecasts. Yet history shows us that even the rare accurate predictions tend to be more luck than skill – those who get it right one year rarely manage to repeat their success. Last year provides a perfect example, with most major institutions significantly underestimating the S&P 500’s eventual return.

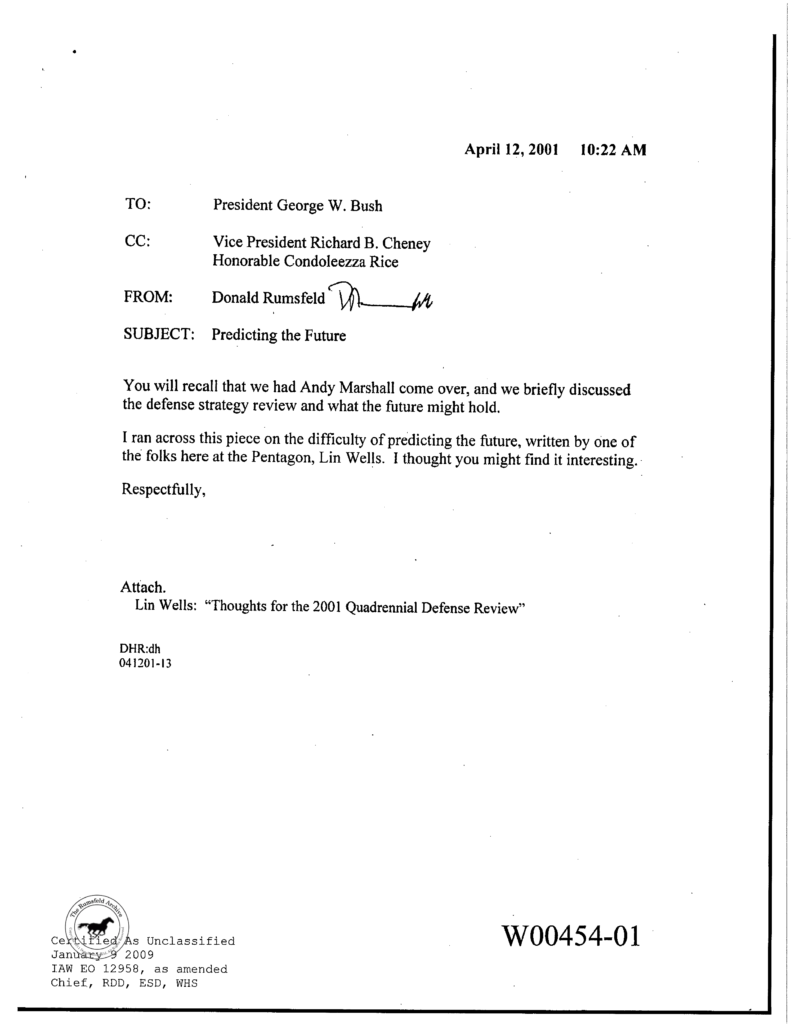

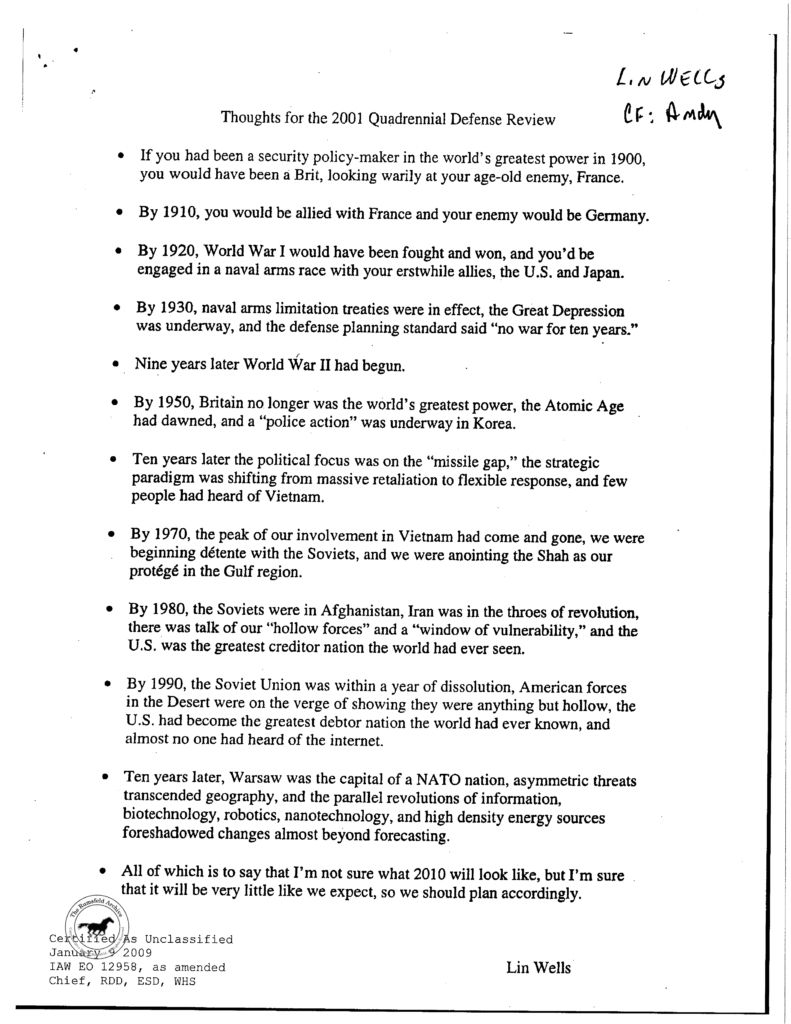

This was on my mind recently when I heard about a fascinating piece of history while listening to a podcast. On 12 April 2001, Donald Rumsfeld, then US Secretary of Defense, sent a memo to President George W. Bush with the subject: “Predicting the Future”. Attached was a note by Lin Wells reflecting on how dramatically the world changed in each decade of the 20th century. Taking the year 1900 as his starting point, Wells highlighted how at each ten-year mark, the world looked radically different from what anyone might have predicted a decade earlier.

What struck me most wasn’t just the profound changes he described, but the timing of the memo itself – just five months before 9/11, an event that would reshape the world in ways that would have been impossible to foresee that April.

It’s a powerful reminder that the future rarely unfolds exactly as we expect. And while this might seem unsettling, I’ve come to see it as quite grounding. It reminds us to focus on what we can control and prepare for a range of possibilities, rather than trying to predict specific outcomes.

This philosophy shapes how we think about financial planning at Emery Little. While we can’t know exactly what the world will look like in 2034, we can focus on building resilience and maintaining the flexibility to adapt as circumstances change.