While we have extensive experience helping bp employees and alumni optimise their benefits, Emery Little operates independently and is not affiliated with or endorsed by the bp group, including BP Pension Trustees Limited, on behalf of the BP Pension Fund. This allows us to provide objective, independent guidance focused solely on your best interests.

We recently met with a client who works at bp as a senior engineer, who wants to grow to Senior and Group leader level. Let’s call her Olivia – she’s 37 and earns £119,000 a year. She’s already saved £235,000 in her bp DC2010 pension pot with Aegon and puts 10% of her salary into it each year. bp matches that with another 10% through their scheme.

The challenge

Olivia asked us a question many bp professionals wonder about: “Should I keep putting the maximum into my pension, or should I put some of that money into other investments?”

We hear this often, especially from people with high salaries who worry about pension limits or who like the flexibility of ISAs, property, or paying off debts. Some of Olivia’s colleagues told her she might be “saving too much” in her pension and missing other chances.

Our numbers show a strong case for getting the full bp pension match before looking at other options.

Let’s see what Olivia’s pension could look like in the future…

The bottom line

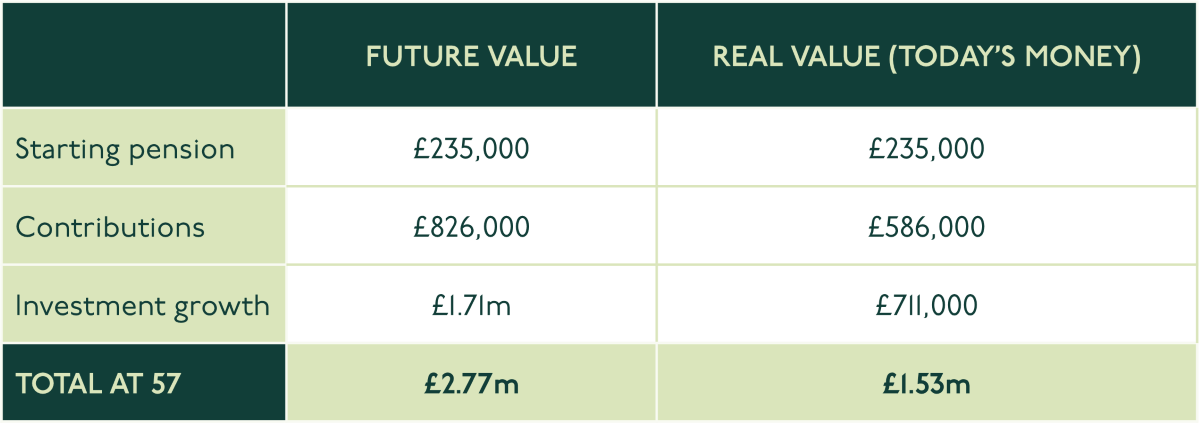

By age 57:

- On paper: £2.77 million

- In today’s money: £1.53 million (after accounting for inflation)

We’re using an 8% yearly return in our calculations (with 3% inflation). This is reasonable for a globally spread portfolio over many years.

How it breaks down

Salary Growth

- Now: £119,000

- Age 57: £316,000 (£175,000 in today’s money)

What this really means

- Compound growth does most of the work – almost 62% of the final amount comes from investment returns, not Olivia’s contributions.

- Inflation reduces buying power – her £2.77m will only buy what £1.53m buys today.

- Her early start is valuable – the £235,000 she’s already saved at 37 becomes about 15% of her final pension.

- Future money buys less – by retirement, she’ll need £2 to buy what £1 buys today.

The takeaway for bp staff

- Use bp’s matching – if you’re not getting bp’s full 10% match in the Retirement Savings Plan, you’re missing out on free money.

- Think in today’s money – always convert future amounts back to today’s values.

- Spread investments globally – diversify worldwide to aim for those 8% returns.

The numbers are clear – compound growth plus regular saving leads to financial security. Even with inflation reducing your returns, you can still build a large retirement fund by age 57.

Conclusion: The million-pound decision

After seeing these projections, Olivia decided to keep maximising her pension contributions to get the full bp match. As she said, “Turning down a 10% instant return on my money would be madness.”

While ISAs and other investments are important in a complete financial plan, our analysis showed that not taking bp’s matching contribution would mean missing out on hundreds of thousands of pounds over her career.

The power of compound growth combined with bp’s generous matching creates a wealth-building system that’s hard to beat with other investments. For bp employees, this employer match is one of the most valuable financial benefits available – and it works even better the earlier you use it fully.

You might guess Olivia’s follow-up question: “Can you guarantee me 8% though?”

Well, no. Nobody knows exactly what returns will be over the next 20 years; we only have history as our guide. But with proper investing, you give yourself a good chance of achieving similar results.

If you know someone at bp who might benefit from this information, please consider sharing this article with them. Sometimes seeing the numbers can help make complex decisions clearer.

If you’d like us to go through your specific numbers and see what’s possible for your pension, get in touch with us. We can help you understand exactly what your bp benefits could look like in the future and how to make the most of them. Every person’s situation is unique, and we’re here to provide clarity on your options.

Want to receive these bp-focused insights directly in your inbox? Sign up to our bp Insights newsletter for regular updates based on our 30+ years of experience serving the bp community.

Note: These projections assume 8% investment returns, 3% inflation, and 5% annual salary increases. Market performance varies over time and individual results will differ from these projections.