In issue five, my colleague, Marcus, mentioned the concept of market timing and how we avoid it in all forms. This provided inspiration for today’s issue.

One of the greatest temptations in investing is to try to time when to be in or out of markets. It is logical to want to be fully invested in the equity markets when they are going up and to be in cash or bonds when they are going down. It would be great to be able to capture the upsides and avoid the downsides, but that is wishful thinking.

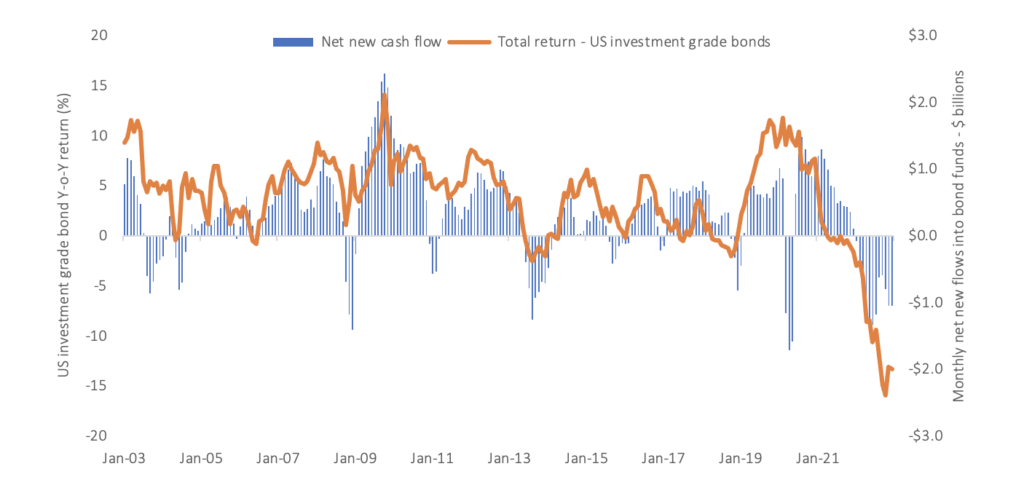

Despite an abundance of data and evidence showing that trying to time the markets is a futile exercise, its allure persists. The chart below provides an insight into US investors’ net flows into bond funds annually over the past 10 years. Whenever bond returns are strong, money flows into bond funds, and conversely, when they are weak or negative, investors tend to sell out of bonds, with 2022 being a prime example. That makes no sense.

Figure 1: Some investors tend to be influenced by good or bad performance.

View full size image here.

Source: Net flows ICI Funds Factbook 2023, bond index data from Morningstar Direct ® All rights reserved. Data series used: SSgA SPDR ETF. Returns in USD. 23/01/1993 – 30/01/2023. Net new cash flow is reported as a percentage of previous month-end bond mutual fund total net assets, plotted as a three-month moving average. Data exclude high-yield bond mutual funds.

It is worth remembering that every decision to get out of any asset class also requires a decision on when to get back in, and vice versa. The chances of getting this wrong are high and the impact can be costly.

An analysis of missing the best days in the market (Albion, 2023) provides some food for thought, as the figure below illustrates.

Figure 2: Missing the best few days in the markets could be very costly.

Whilst these types of study imply a binary approach to being invested in equities or cash, which is a somewhat unreal scenario, it is evident that a few good days, weeks, or months drive the bulk of market returns and missing them can be costly. Being out of the market during the best 30 days in this 30-year period (1993-2023) significantly impacts on your return.

Likewise missing the worst 30 days would be highly beneficial, yet the ability to pick them does not seem to show up in the data. The October 2022 Liz Truss/Kwasi Kwarteng ‘mini budget’ in the UK provided evidence of just how quickly new information can impact markets, in that case the bond market. Being right is quite a challenge when the odds of successful market timing are slim.

It would be perfect if there was a clear signal that allowed us to make these calls, but as the late, great, John C. Bogle, the founder of Vanguard once said:

‘The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has done it successfully and consistently.’

We agree. There is no evidence which suggests market timing can be done reliably. The good news is that you don’t need to time the market to have a positive investment experience. Over time, equity markets have rewarded those who take a long-term perspective.

Stay invested.