In the last few months, dubious party-going-politicians aside, inflation numbers have been a feature in the headlines and remain a key consideration or concern for many of our clients. We want to share our thoughts and insights on the subject and would encourage you to get in touch if you have further questions.

So, what is inflation?

In short, inflation measures the general increase in the price of goods and services.

Left unchecked, it can be a silent and dangerous foe, eroding the purchasing power of one’s hard-earned cash over time. Financial stimulus around the globe has meant that more money circulating in the economy is chasing a similar (or fewer) number of goods and services, resulting in price increases.

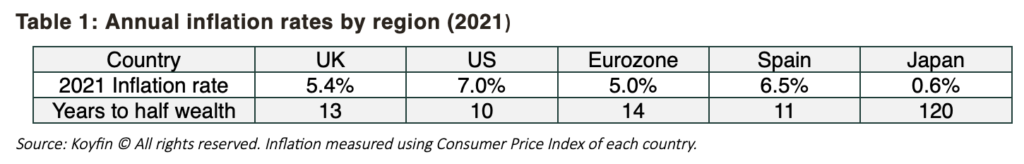

The table below from our investment analysts shows the latest annual inflation figures from around the globe, measured using the consumer price indexes (CPI). Most countries have not seen numbers this high since the early 90’s. Using the rule of 72, where you divide 72 by the inflation rate, you can get a sense of how quickly purchasing power halves at these higher-than-average rates.

Contrary to its negative associations, the consensus of economists has shifted over the years, the modern position is that a small amount of annual inflation is, in fact, a good thing! The Bank of England, for example, targets an annual inflation rate of 2%. Primarily, this is to avoid an alternative scenario where prices are falling each year and consumers are encouraged not to spend at all, but to wait until prices fall further. The danger with a deflationary environment is that it is a very hard cycle to get out of, price falls tend to lead to further price falls – most notably experienced before the turn of the century by our friends in Japan.

So, with inflation (hopefully) here to stay and not always a bad thing, what else do we need to know and what can be done about it?

Inflation essentials

Firstly, let’s unpack the difficulty of how inflation is measured. Although the inflation rate is generally thought of as a single number, the consumer price index in the UK is measured using around 180,000 different prices across 720 different goods and services each month. What is more, the ‘shopping basket’ is weighted using estimates of the average UK consumer, which is updated each year depending on spending patterns. This is a valid criticism of CPI indexes, as they do not account for substitutions of expensive products for less expensive ones. For example, around half of the declared 5.4% CPI rate for December 2021, came from increases in transport and energy prices, whereas healthcare and communication services had negligible impact.

The reality of any CPI figure is that, whilst it is a reasonable estimate for the average consumer, everyone is subject to their own unique inflation rate which is naturally harder to track. For example, individuals living in older houses that are poorly insulated are likely to be feeling the effects of higher energy costs more than those living in new-builds with modern insulation and renewable energy sources.

The effects of inflation

There is no doubt that inflation can impact us all differently; perhaps in the increased cost of day-to-day goods and services, or because we fear our trusted cash reserves will lose their purchasing power at an increased speed.

The best way for our clients to manage this is to work with us to determine how much cash to hold as an emergency buffer (not too much or too little). Then, knowing that the companies of this world rely on the increased costs of goods and services they provide to make their profits, we ensure we that we adopt a systematic approach to capturing those profits within your investment portfolios, to weather the inflationary storms.

While no perfect inflation hedge exists, ensuring a sufficient portion of your wealth is suitably invested in a well-diversified portfolio consisting of equities and high-quality bonds, will give you the best chance of achieving above inflation returns over a multi-decade time horizon.

Risk warnings

This blog is shared for educational purposes and should not be considered investment advice or an offer of any security for sale. This blog does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.