In a moment of what I can only describe as temporary insanity, I recently decided to run my first marathon in València. Fortunately, I had my husband Tom (a seasoned marathoner with a rather show-offy personal best of 2:31) as my pacer. Somewhere between “this isn’t so bad” (kilometre one) and “why did I ever think this was a good idea?” (kilometre 25), I started drawing parallels between marathon running and financial planning — possibly because I’d chosen to run without music, leaving my mind free to wander into financial planning mode. Even during a marathon. Yes, I know.

Here are ten things I learned about financial planning while questioning my life choices over 42.2 kilometres:

1. Start early and stay consistent

Just as marathon training requires regular, consistent effort over many months, the most successful financial planning journeys begin early and maintain steady progress. It’s not about sporadic bursts of activity but rather about building sustainable habits that last.

2. Don’t watch every wobble

Checking your running watch every kilometre is like checking your investment performance daily – it’s a recipe for unnecessary stress and potentially questionable decision-making. Neither your running pace nor your portfolio will move in a straight line, and that’s perfectly normal. Instead, measure progress in longer intervals, allowing you to maintain perspective and stay focused on your long-term goals.

3. Find your pacer

Having Tom as my pacer was invaluable. He had the experience, fitness, and dedication to help me achieve my goals. Similarly, a good financial planner should have the expertise and dedication to guide you through your financial journey, adapting plans when needed while keeping you focused on your objectives.

4. Run your own race

Just as every runner has different goals and training backgrounds, every client’s financial journey is unique. Don’t be distracted by what others are doing or achieving – focus on your personal goals and plan.

5. Every stage has its strategy

Just as different sections of the marathon demand different strategies – careful pacing at the start, steady effort in the middle kilometres, and determined focus in the final stretch – your financial approach needs to evolve through life’s stages. What works in your early earning years might need adjusting as you approach retirement, just as my running strategy (and need for energy gels!) changed dramatically between kilometre one and kilometre 40.

6. Get a coach

Could I have googled “how to run a marathon” and figured it out myself? Probably. Would it have been as effective as having proper guidance? For me, absolutely not. The same goes for financial planning – yes, there’s plenty of information out there, but sometimes working with a knowledgeable coach or adviser can make all the difference. They provide structured guidance, accountability, and personalised strategies based on expertise. If you know someone who might benefit from this kind of support, you can share our approach with them here.

7. Control the controllables

I spent an embarrassing amount of time checking the València weather forecast – as if my constant refreshing would somehow improve it. Instead of worrying about things you can’t control (weather, markets, other runners’ choice in outfits), focus on what you can.

8. No new tricks on race day

Just as you wouldn’t try new running gear or nutrition on race day, it’s wise to avoid chasing the latest investment fad or making dramatic changes to your financial strategy without proper consideration and testing.

9. Trust the tried and tested

Sometimes the boring stuff is the best stuff. In running, it’s regular training, proper nutrition, and staying hydrated. In financial planning, it’s regular saving, diversified investments, and maintaining a long-term perspective. Not exactly TikTok-worthy advice, but it works.

10. Enjoy the journey

In both marathons and financial planning, the goal isn’t just to reach the finish line – it’s to get there feeling good about the journey. And yes, maybe even enjoy some of it along the way.

As I write this in the warm afterglow of marathon completion, I’m struck by how similar these two journeys really are. Success in both requires preparation, patience, and partnering with the right people to help you achieve your goals (if they carry extra snacks, that’s a bonus).

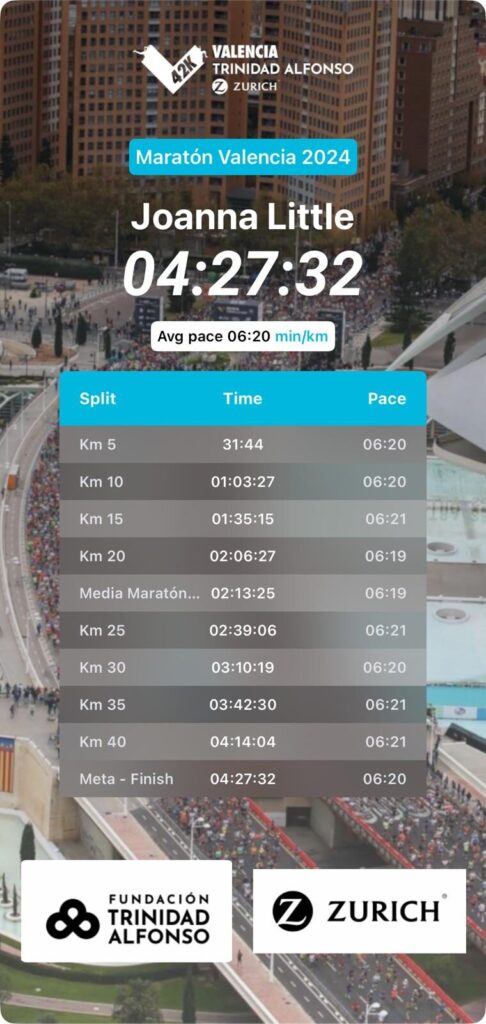

And for those wondering – yes, I did achieve my goal of running sub-4:30. Though unlike financial planning, I’m fairly certain this marathon will be a one-time achievement. At least, that’s what I’m telling myself right now.