Hopefully by now you’ll have had the chance to read the brilliant issue released a couple of weeks ago, written by my good friend and colleague, Marcus Farnfield.

Marcus explored the three traits investors need to adopt in order to enjoy a successful investment experience: faith in the future, patience and discipline. If you missed it, you can catch up here.

If put into practice over an investing lifetime, all three traits will help to set investors up for success.

Success will of course mean different things to different people. As financial planners, we tend to view success as achieving and maintaining financial freedom.

Morgan Housel, author of the bestselling book Psychology of Money neatly defines financial freedom as ‘having enough to be able to do what you want, when you want, with who you want, for as long as you want’.

Managing the key threats

To ensure you can continue to enjoy financial freedom, there are several threats that we need to manage along the way, some of which are beyond the scope of this writing. However, one threat towers over the others: the risk of having the purchasing power (the ‘real’ value) of your wealth mercilessly destroyed by inflation. Inflation is a silent wealth-killer.

If inflation is the disease, then history has shown us that an investment portfolio comprised of the world’s greatest companies (equities) is the closest thing we have to a cure. As is the case with many cures or medicines, unwelcome side effects are to be expected. With ownership of equities, the side effects are extremely unpleasant-albeit-temporary declines in value (think dot-com crash in 2000, the financial crisis of 2007-2008 and the Covid-crash in 2020), as well as numerous smaller declines.

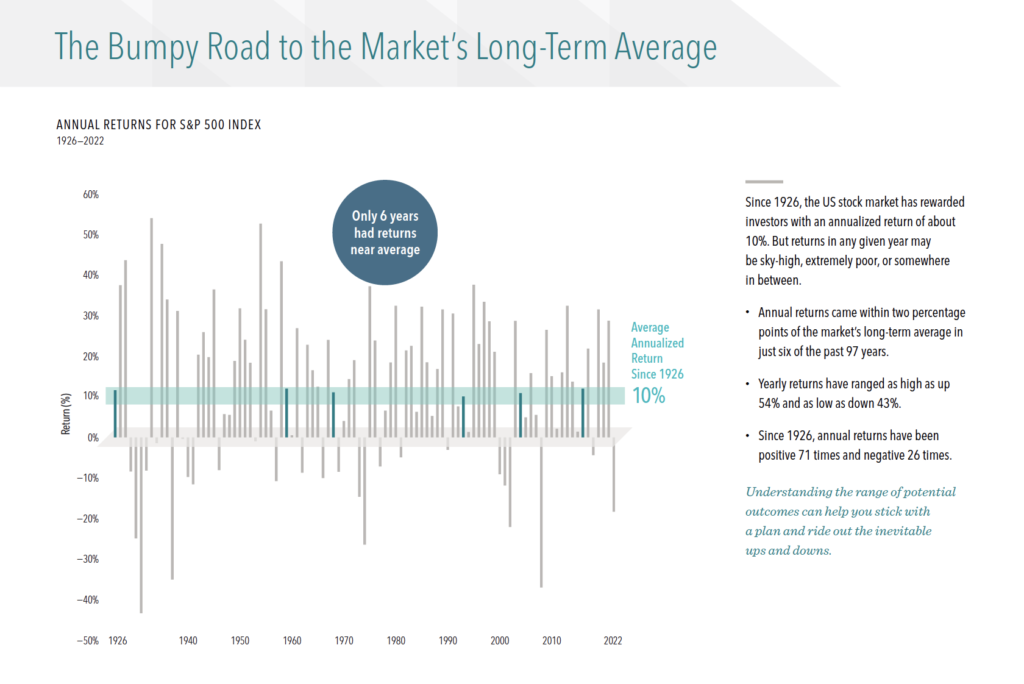

You’ll often hear us talk about the reward for retaining a long-term view, screening out the short-term noise and sticking to the plan. This can be very difficult, but if achieved, the reward should be growth of the purchasing power of your wealth, and most importantly, a life free from financial worry. History supports this view; for example, since 1926 the US stock market has rewarded investors with an annualised return of about 10%. This means a ‘real’ return of somewhere between 6-7% a year during that time.

We use the US market as it remains the largest stock market in the world, by some distance. By comparison, the UK market represents less than 5% of world market capitalisation.

This all sounds wonderful, doesn’t it? Well, there is an important caveat, one that forms the basis of this blog: the danger of averages.

Averages are a false friend

Here’s the real issue, in nearly a century of market history, the market has rarely been close to producing ‘average’ returns. Therefore, average is highly unlikely to describe the experience of a real equity investor. Investing is an emotional rollercoaster and so it’s important that we understand the range of potential outcomes when setting expectations for the future.

Dimensional releases a chart each year which encapsulates this brilliantly, titled ‘The Bumpy Road to the Market’s Long-Term Average’ which can be seen below.

Source: Dimensional Fund Advisors

Staggeringly, in the past 97 years, the US market came within two percentage of the average on just 6 occasions. During that time, yearly returns ranged from a whopping 54% to as low as -43%. Far from average.

As you can see, this volatility is perfectly normal and to be expected. In his book The Geometry of Wealth, Brian Portnoy describes volatility as being “the emotional cost of achieving the growth we seek”. It’s a description I like using.

Long-term investing isn’t easy. As humans we tend to crave certainty, but in investing, especially in the short-term, uncertainty is the only certainty. As investors, we would all benefit greatly from thinking in terms of likelihood of outcome. Those who can do this, whilst also exercising the patience and discipline Marcus outlined last time, are far more likely to benefit from the remarkable power of equities in the long run.

As investors, we should acknowledge the reality of the investing journey. This will help us to ride out the inevitable bumps along the way. Of course, we’d all love to benefit from a consistent 10% return each year, but it’s also completely unrealistic. Volatility is the price of admission for future returns.

As your financial planners, we have a large role to play in the success of your investing journey. Simply, we will do everything in our power to ensure that you don’t make bad investment decisions based on (human) reactions to short-term market movements. This is in no small part what you pay us your hard-earned money for.