In the last post, I explored the role that timescale plays in the way that we think about investing. We discussed the short-term games that speculators play, and the long-term games we’re interested in as investors looking to power financial plans for the years ahead. If you missed it, you can catch up on it here.

It’s reasonably obvious to say that the game at play impacts the assets that are being bought. Speculators typically hold concentrated positions in whatever they think is going up in price, while investors are thoughtful about portfolio structure and diversification levels. In this article however, I want to explore the less obvious topic of how knowledge of the game at play impacts the way that investors should think about their own behaviour.

Nick Murray, an adviser to financial advisers, explains that being a successful investor requires three traits: faith in the future, patience and discipline.

The first is reasonably self-explanatory and is, to my mind, what choosing to invest is: an expression of the fact that you believe that tomorrow will be better than today. Hans Rosling’s wonderful book Factfulness is the best I’ve yet found for the investor looking for some healthy perspective in this department. It charts the phenomenal progress our species has made in improving quality of life for all and is well worth a read. This faith is foundational to the task of staying the course, and tuning out the noise, in the years ahead.

Patience and discipline however are two sides of the same coin with the former being the choice made by an investor “not to do the wrong thing” and the latter being the decision to “keep doing the right thing”.

The “wrong” thing that we can all be tempted to do is to begin to play short-term games with our money when the real task we face is long-term. Examples of this include wanting to get in on recent trends – tech stocks in the late 90s and cryptocurrencies over the last few years both come to mind – or to sell out of the equity market when it’s temporarily falling in value.

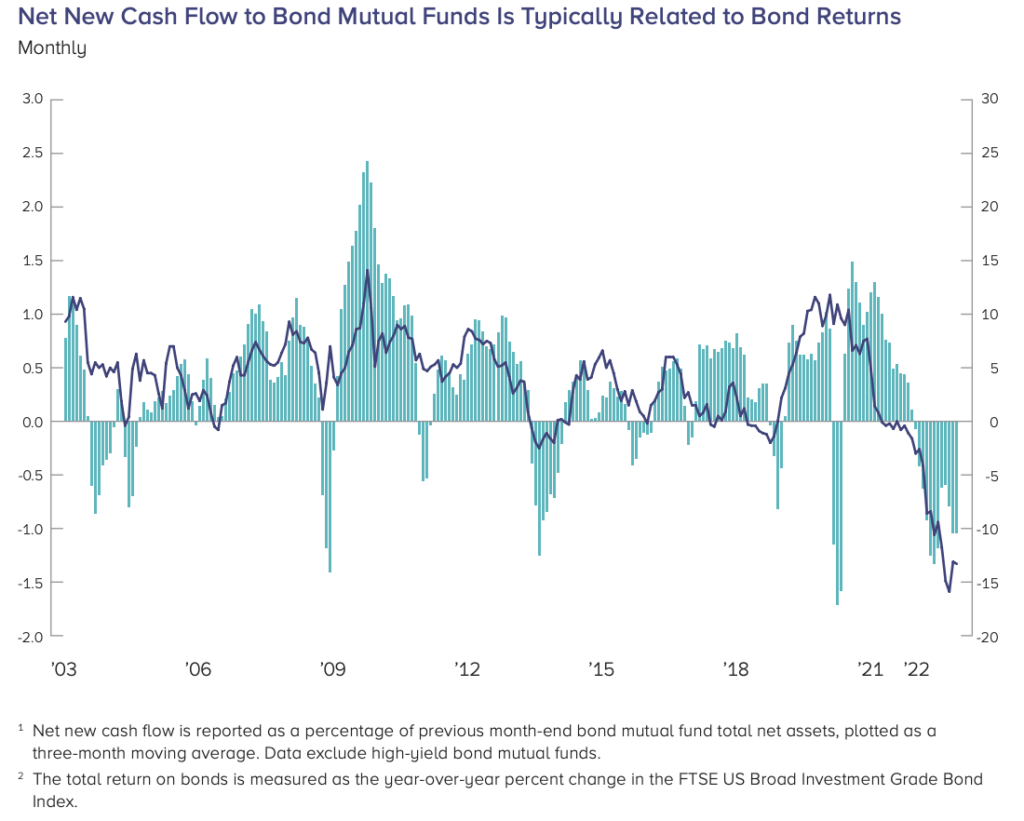

Left to their own devices, the wrong thing is what investors as a whole tend to do. The chart below shows aggregate inflows and outflows to bond funds with an overlay of the price of those funds. As you’ll see, when prices go up, money comes in and when they go down again, money flows out. This short term buying high and selling low can often lead to investors getting worse returns that the funds themselves and is why we avoid market timing in all its forms.

Source: Investment Company Institute, FTSE Russell and Refinitiv

The “right” thing we should be choosing to do instead is to continue to act as an investor irrespective of the noise that’s going on around us.

For our readers who are still in employment, an example of this might be continuing to invest surplus earnings each month through a falling market rather than keeping cash aside “until the market comes back”.

For all investors however, the right thing is to remove all trace of speculation from the component of our wealth that’s required to power our financial plans; to have a single coherent, diversified investment strategy.

As such, I believe that this rather wonderful advice could be rephrased as: have faith, don’t act as a speculator, do act as an investor.

I’ll end with a concept that I’ve found myself thinking about over recent weeks; the question of when we actually earn the return that we expect as investors. I think we’d all intuitively say that we earn it when it arrives – when the portfolio “goes up”. My view however is that we earn the return during the periods when we have to exercise our patience and our discipline and are then rewarded as the uncertainty abates and the market resumes its permanent advance. We’re paid in arrears for the work we’ve already put in.

So while the market continues to hold back on providing that meaningful return, keep the faith and keep doing that hard work of exercising your patience and your discipline; you will be rewarded for your efforts, eventually.