One of the odd things about investing is that it’s a term that covers a large number of people playing many different games but all on the same pitch and all at the same time.

The pitch is of course the market with the key difference between the games at play being the timeframe. One could simplify this down to the following statement: speculators play short term games; investors play longer term games. All are interested in prices.

Before we get into this in more detail, let’s remind ourselves what a stock price is. It’s an expression of the value of the expected future cash flows of a business that are available to a shareholder, discounted back to today. As such, it’s affected both by the expected volume of those expected cash flows, and by the rate used to discount them back. A “riskier” business will have a higher discount rate applied by investors than an equivalent “safer” business, and will have a lower stock price as a result. This reflects the belief of investors in aggregate that the company has higher likelihood of failure and that the expected cash flows won’t materialise.

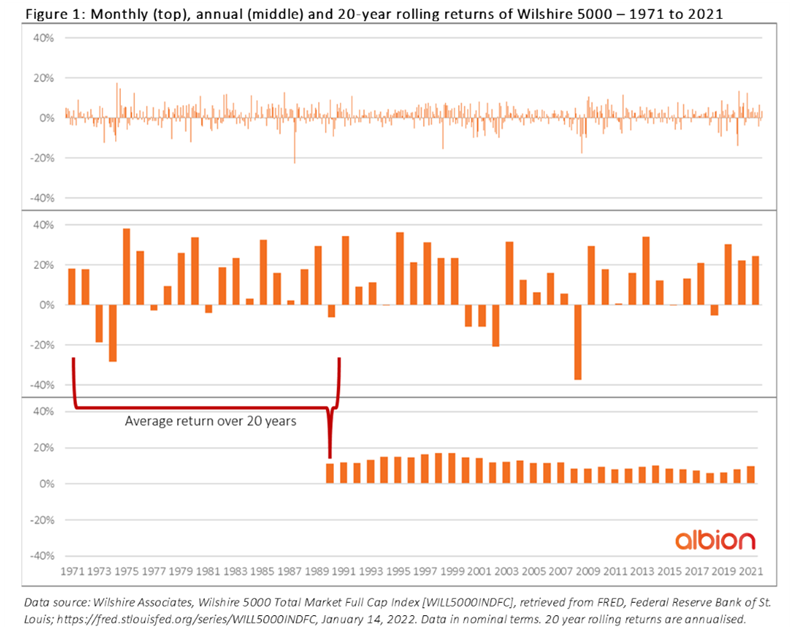

Benjamin Graham, one of the great investors of the twentieth century, alluded to the difference that timeframe plays in the way we can think about the market when he said that in the short term the market is a voting machine, but in the long term it’s a weighing machine.

What he meant by this was that, in the short term, the movements of the market have much more to do with votes (purchases and sales) being made by investors, than with the actual value (weight) of the companies in question. To think about this a little more, ask yourself whether the true value (a quantity that can never be known) of a company actually changes in the short term when its stock price fluctuates? No – of course not. The price change is simply a reflection of a change in the way that people think and feel about the company – reflected via a change in the discount rate they apply.

Over the long term, investors are rewarded for taking on the risk of parting with their capital in the pursuit of returns, which are delivered either in long-term stock price appreciation or via the receipt of dividends. It’s this that we’re accessing when we choose to behave as investors, rather than speculators.

Fig. 1 The two machines in action.

I hope it’ll come as no surprise to learn that the challenge of powering financial plans for the decades ahead requires investment, not speculation. As investors, we need to remember that short term fluctuations are points on the board for a game that we’re not playing. Our score is racked up over years and only comes to those who have the required patience and discipline to stay the course.

Patience and discipline are subtly different and both are behaviours we can learn as we seek to become better investors. To put your patience to the test, you’ll have to wait until the next edition of Little Thoughts before we get into this in more detail.

If you’re interested in discussing your financial plan and investments, please get in touch.