We asked our investment partners to share their thoughts on whether it’s possible to ‘beat the system’ when it comes to investing.

—

The simple maths of trying to beat the market guarantees that – after costs – the majority of investors, including professional fund managers, will fail to achieve the return that the market offers, as trading stocks (or bonds) is a zero-sum game. In other words, every winning trade relative to the market must be funded by the losses on the other side of the trade. Not everyone can win.

That may be surprising to some. Surely highly paid, intelligent, hardworking, ambitious fund managers with vast resources available to them should be able to outsmart other investors? With the advent and popularity of market tracking index funds, however, weaker investors – including professionals – will have exited the game, leaving the now higher quality pool of survivors competing amongst themselves for winning trades. The bar has been raised significantly. Surely there must be a few great managers out there? Maybe, but identifying them is extremely challenging, contrary to popular belief.

Consistency counts

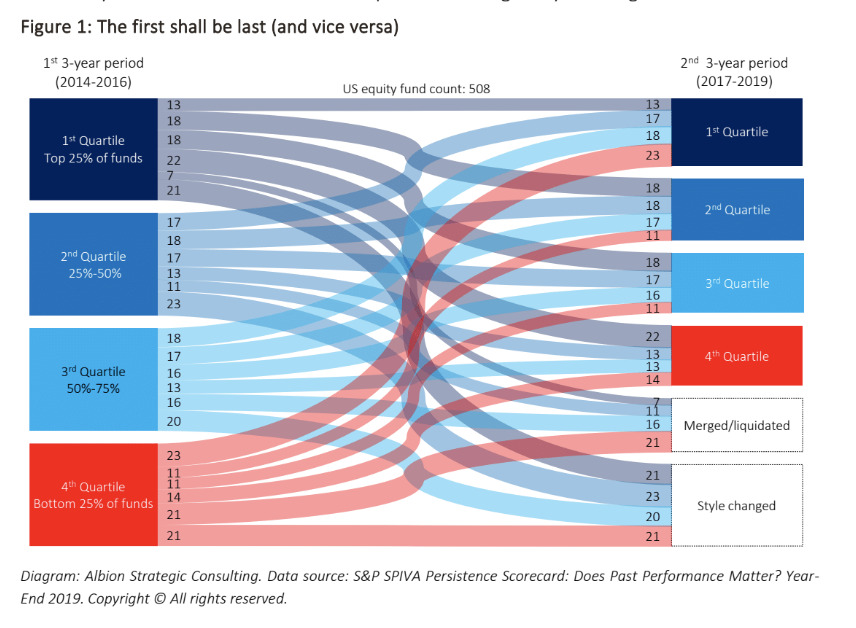

Many studies show that short-term performance rarely persists. In other words funds that perform best in one period rarely carry on this ‘good’ performance, at least with no greater frequency than we would expect simply from by luck. Take a look at the chart below that looks at two consecutive three-year periods. The funds are ranked into quartiles in the first period and then ranked again in the second period. If managers were truly skilled, the top quartile (best) managers should remain top quartile, and the bottom quartile (worst) managers should stay at the bottom. That is clearly not what happens. See how the quartiles migrate and notice how many funds fail to survive the whole period or changed style. Not good!

These results are little different to those expected if only luck was at play. Most attempts at fund picking by individuals – or advisers they pay to do this on their behalf – use three- to five-year performance data, which means it is almost statistically impossible to tell skilled managers from the noise of the markets. Luck will largely drive outcomes, good or bad.

When does luck turn into skill?

Even if a fund manager beats the market over a longer timeframe, it does not automatically mean that they are skilled. To separate skill from luck, we need at least 16 years of data to be 95% sure that we are looking at the former rather than the latter. Not very many fund management firms can provide a historical track record that is representative of the team and process currently in place. That raises a number of pertinent questions investors should ask themselves. Is it really possible to extrapolate past success into the future? On what basis would one take this risk? Will the current manager be around in the future? Without a crystal ball, the odds of picking a skilled, market-beating fund manager for the years ahead is pretty low. There may be some out there, but identifying them today is a real challenge, with a potentially costly downside.

Fund selection based on luck is not a good investment strategy. Investors do not need to play this game. Play the odds in your favour and pick up the market returns you deserve.

We’re sharing this article for educational purposes and it should not be considered investment advice. Information contained in this post has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.