Promises, promises…

All fund managers make promises. Some are easier to keep than others. Active managers promise that through their insight and judgement they will deliver returns above their reference market benchmark index after the costs they incur, which include their own fees and costs, and the costs of trading assets in the portfolio.

Passive (a.k.a. index) managers make a different promise: to deliver as much of the reference market index as possible, after the frictional costs that deplete market returns.

There is also a third category of managers – which we call systematic managers – who seek to structure portfolios that provide the opportunity to beat the market, not based on judgmental views of shorter-term market and individual stock forecasts, but by including long-term strategic tilts in their portfolios to risks that are incremental to the overall market risk, informed by the long-term data and academic research available. Their portfolios do not hold securities in exact market weights (making them active in a purist sense).

Similar to index managers, such firms focus in great depth on how such strategies are implemented and how skilful trading can reduce the frictional costs of implementation. It’s this systematic, evidence-driven approach to investing that underpins our True Wealth portfolios.

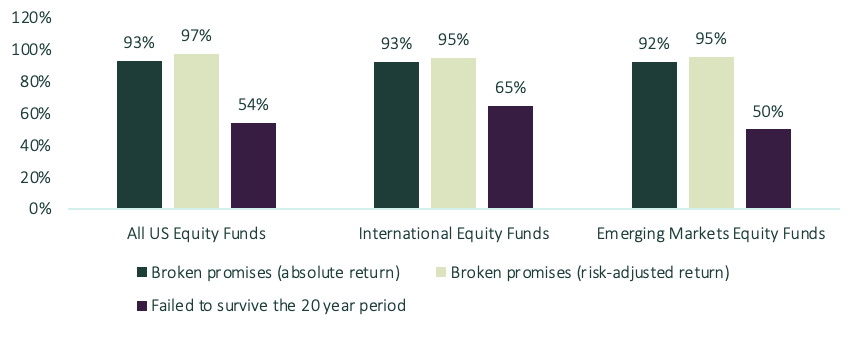

Let’s look at how well active managers using their judgmental skills fare in delivering on their promises. To help us do this we can look at the recently published SPIVA® US Scorecard – Mid-Year 2023 report. This study has been undertaken for more than 20 years in the US and provides us with insight into what proportion of active managers break their promise to beat the market after costs, or even simply to survive the period! It’s fair to say their record makes for sorry reading – take a look at the figure below.

Figure 1: Percentage of active managers breaking their promises over 20 years

See full sized image here.

Source: SPIVA® US Scorecard – Mid-Year 2023 © All rights reserved.

Other studies tell the same story [see footnote 1]. Hoping to pick the few active managers that deliver on their promise is extremely challenging: some may simply be lucky, and so discerning and picking the skilled managers at the start of the period, without the luxury of hindsight, is extremely difficult. The legendary investor Jack Bogle used to encourage investors not to try to pick the needle from the haystack.

The story is entirely different for index funds. In this case, it’s quite straightforward to identify a good fund today that is likely going to be a good fund in the future. Costs, fund size and a manager’s experience of running index funds are a good starting point. The promise to deliver the market return is relatively easy to gauge by plotting the return of a fund (red line) [see footnote 2] against the benchmark it’s tracking (blue line) [see footnote 3], as you can see in the example below. The peer group average of funds in this sector is shown in grey. Again, this is not a good advertisement for the judgement-based active management industry.

Finally, good systematic managers are easier to identify than judgmental active managers, but the task does become more complex, requiring advisers to undertake deep due diligence on the fund manager’s approach.

Dimensional Fund Advisers (a name you’ll likely be familiar with given their prominence in your portfolio) are one such systematic active manager. Dimensional recently revealed that over the past 20 years to 30 June 2023, of their US-domiciled equity and fixed income funds, 100% of their funds survived and 77% outperformed their benchmarks compared to 46% and 16% respectively for the industry. That’s a pretty good outcome.

As the British businessman Harold Geneen (one-time in charge of ITT) once said:

‘It is an immutable law in business that words are words, explanations are explanations, promises are promises – but only performance is reality.’

We agree.